This is a reprint of a feature that originally ran on the PYMTS.com on March 14, 2022.

Consumer interest in buy now, pay later (BNPL) options is growing at breakneck speed, creating a massive opportunity for market entrants to gain a foothold. Banks that respond to this consumer interest will be entering a market that already appeals to more than half of United States consumers, as 52% say they are interested in using BNPL options, according to recent PYMNTS research. Our data reveals that usage is also rising alongside interest: 65% of the consumers who use BNPL use it more often than they did one year ago.

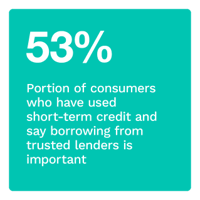

The large portion of consumers who are either increasing their BNPL usage or are interested in giving it a try highlights the opportunity that exists for banks, which are uniquely poised to compete in this rapidly growing market. PYMNTS data finds that 53% of consumers who have used short-term credit say trust in the lender is essential when selecting one, and trust is an aspect of the payments market that has traditionally been a strength for banks.

These are just some of the findings in BNPL, Banks And The Trust Factor: Consumer Trust Offers Banks A Competitive Edge In A Growing Market, a PYMNTS and Amount collaboration. The report is based on a survey of 2,237 U.S. consumers conducted between Nov. 5 and Nov. 10, 2021. Our researchers assessed consumers’ BNPL usage and interest in using bank-sponsored BNPL options in the future. We also sought to identify which attributes they might want from such options to learn how banks can maximize their chances of success.

.png?width=200&name=Landing%20page%20thumbnails%20-2%20(27).png) Some additional key findings include:

Some additional key findings include:

• Fifty-three percent of consumers who have used short-term credit say trust in the credit provider is an important factor they consider when deciding to use short-term credit. Trust in a credit provider is the factor consumers cite most often when listing the items important to their decision. Additionally, 50% of consumers say it is important for them to have the flexibility to spread their payments out over time.

• Sixty-five percent of consumers who use BNPL use it more than they did last year. Banks that issue BNPL options will be entering a market where usage is rising and consumer interest is high — particularly among younger and upper-income consumers. To successfully provide customers with BNPL options, banks will need to tailor their products to the consumers who have used BNPL and increased their BNPL usage during the past year.

• Fifty-two percent of consumers interested in using a bank’s BNPL offering say they value ease and convenience. Consumers also want the ability to track and manage spending. These consumer preferences provide banks with a blueprint to follow for introducing BNPL options with the highest probability of success.

.png?width=200&name=Landing%20page%20thumbnails%20-3%20(27).png)

53% of consumers say trust is the most important factor when choosing a lender for a short-term credit product. Banks have the edge over other FinTechs when it comes to cultivating and retaining consumers’ trust, given the extent to which consumers say trust in a credit provider is a key factor that influences their interest in bank-issued BNPL plans.

Banks have an opportunity to capture a substantial share of the rapidly growing BNPL market. Consumers say they want to be able to trust their credit providers, and trust has traditionally been a strength for banks in terms of how consumers view them. Banks typically have long-standing relationships with their clients, and these relationships can make customers more open to accepting, and using, the products and services banks offer them. Leveraging that trust and offering the flexible payment options that appeal most to BNPL users can help banks build inroads and position themselves for long-term success in the BNPL market.

To learn more about how banks can take a lending role in BNPL, download our playbook "BNPL, Banks & the Trust Factor."

Download Report

Download Report