If you keep up with digital banking trends, you are probably aware of the innovation that is occurring within the point-of-sale (POS) financing space. Just within the past month, we have witnessed Shopify and Affirm announce a landmark partnership while AfterPay released impressive growth figures, including over 1.6M new U.S. customers in the last 4 months.

How banks can win against FinTechs in point-of-sale financing

As I continue to see these trends in my newsfeed, there are two main questions I keep asking:

- How will banks respond?

Is the point-of-sale financing trend real?

Point-of-sale financing is not a new concept. Banks have been partnering directly with merchants for decades by offering extremely lucrative credit card programs to the merchant’s customers. These relationships have benefited banks, merchants, and consumers in the form of co-branded and private-label credit cards. In addition, particular verticals like furniture and electronics have long embraced these credit card vehicles as a way to functionally offer installment loans to customers to entice larger purchases through deferred financing.

So why is there a buzz in point-of-sale financing right now?

The simple answer is that FinTechs have recognized that customers were quickly transitioning to the subscription mindset of buy now, pay later. With this recognition came a huge uptick in the number of FinTech players offering direct-to-consumer financing options.

With so many FinTechs exclusively focused on direct-to-consumer e-commerce, the last 18 months have seen major deals between Affirm and Walmart, UpLift and United Airlines, and more. These same retailers already have very large and established point-of-sale credit card programs.

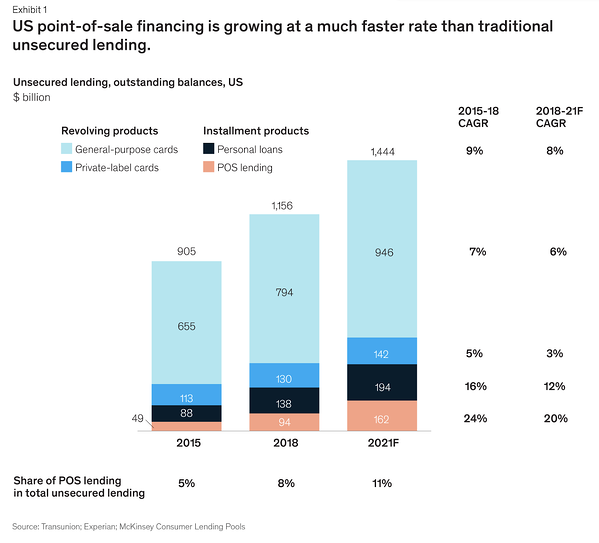

According to McKinsey, POS outstanding balances are expected to grow from $49B in 2015 to $162B in 2021, eclipsing private-label credit cards. This places POS loans as the highest growth-rate vertical among traditional unsecured lending products.

Though it is yet to be seen how this product and these lenders will fare through a complete credit cycle, it is obvious to me that this trend is here to stay and that stand-alone installment loans will continue to chip away at credit card spend.

How will banks respond?

Banks have long enjoyed exclusive and often lucrative point-of-sale credit card relationships with merchants. While these relationships allowed banks to add attractive loans to their balance sheets, they also served as a low-cost way to create additional customer relationships for the bank. These new customers provide immediate benefits and enable future cross-product growth.

At Amount, we talk to senior bank leaders on a daily basis and the sentiment is clear: point-of-sale installment and split pay loans are here to stay. Last year, most bank executives were watching this new market develop but weren’t really worried. Kevin Lewis, Chief Revenue Officer at Amount summed it up:

“Last year, bank executives viewed FinTech players like Affirm as fighting for the tiny crumbs in the POS payments space. That viewpoint has clearly changed. Now banks must respond.”

This stance changed completely after several marquee deals created instant merchant demand, who then pressured banks to add the capability.

Though banks are late to the party, I believe they will quickly regain market share for several reasons:

- Cost of funds advantage

- Established merchant relationships

- Ability to weather credit cycles

- Access to technology

Cost of funds advantage

The top 50 banks in the U.S. have access to large balance sheets that are typically funded through cheap consumer checking and saving accounts. As of the week of August 3, 2020, the FDIC stated that the national average savings rate was just .06%.

In comparison, POS direct to consumer FinTech players don’t have access to this same funding source. FinTech’s are typically reliant on the capital markets, commercial lines of credit or whole loan sales to create the liquidity needed to continue to book loans for their balance sheet. These secondary markets have the tendency to dry up during recessionary periods and the overall average cost of funds can be multiples of that of a bank.

If banks have a lower cost of funds, they are likely able to offer more attractive terms to large, top-tier merchants.

Established merchant relationships

Large banks have many long-term relationships with merchants both through the POS credit card programs and through commercial banking relationships. These experienced bankers truly understand the needs of the merchants and their customers and are likely viewed as partners in building great long-term businesses. It is only logical that if all things were equal, large merchants would prefer to choose their existing POS credit card issuer for an extension into POS installment or split pay loans vs. adding a new POS FinTech player.

Ability to weather credit cycles

The verdict is still out on the resiliency of POS installment loans, but what is clear is that banks have been tested time and time again through cycles. Banks live and breathe by their ability to effectively underwrite loans. Weathering credit-cycles is in the DNA of every large bank.

Because of the obsession with credit, banks have been able to continue to lend in the POS financing space even at the bottom of cycles, though credit may tighten. The ability for POS lenders to continue to approve POS loans is critical for merchants as these approvals often lead to higher merchant sales.

Access to Technology

Though banks are clearly behind in the technology race to offer new POS financing options to their merchants, they can catch up fast. In 2020, banks are projected to spend $285B on technology. If needed, the top banks could easily divert tens of millions of dollars to build their own internal infrastructure to originate and service these loans.

Alternatively, banks have the ability to partner with a proven technology provider like Amount. Amount provides white-labeled point-of-sale installment and split pay functionality through end-to-end, cloud-based solutions that empower financial institutions to offer customized financing options to merchants and their customers.

It has been an incredibly fascinating time to watch the POS financing trend develop and to witness first-hand how banks have responded to this new challenge. From my vantage point, it is clear that consumers will continue to demand this product. It is also clear that POS installment loans will continue to displace credit card wallet share at merchants. Banks have core advantages that will allow them to quickly catch-up and ultimately beat direct to consumer POS FinTech lenders. Is your bank ready for the challenge?

To learn more about BNPL and how to find the right fit for your organization, read our recent post "Buy Now, Pay Later Partnership Models: Which is Right for your Financial Institution?"

Read Article

Read Article