Buy Now, Pay Later (BNPL) is taking the consumer marketplace by storm. Increasingly adopted by merchants across multiple industries, BNPL is a credit option that offers customers newfound flexibility in making installment payments at the point of sale.

Nonetheless, BNPL has received some negative press, resulting in several myths that falsely paint it in a bad light. Some common stereotypes about BNPL users are that they are credit-averse and credit-light, which leads to BNPL supposedly being a less desirable payment option.

In Amount’s recent research study on BNPL users, Buy Now, Pay Later: Today’s Greatest Customer Acquisition Opportunity for Banks, we find that these negative narratives surrounding BNPL simply do not hold water. In fact, there is plenty of reason to believe BNPL will be a powerful force in the world of payment options for some time to come — and that banks would be wise to get in on the BNPL action.

Here are four of the most common BNPL myths our study disproves.

1. BNPL is a fad.

One of the most pernicious BNPL myths? That it’s just a passing fad in consumer finance. According to this narrative, once the Millennial and Generation Z fascination with BNPL has passed, this new payment option will be dumped into the waste bin of history.

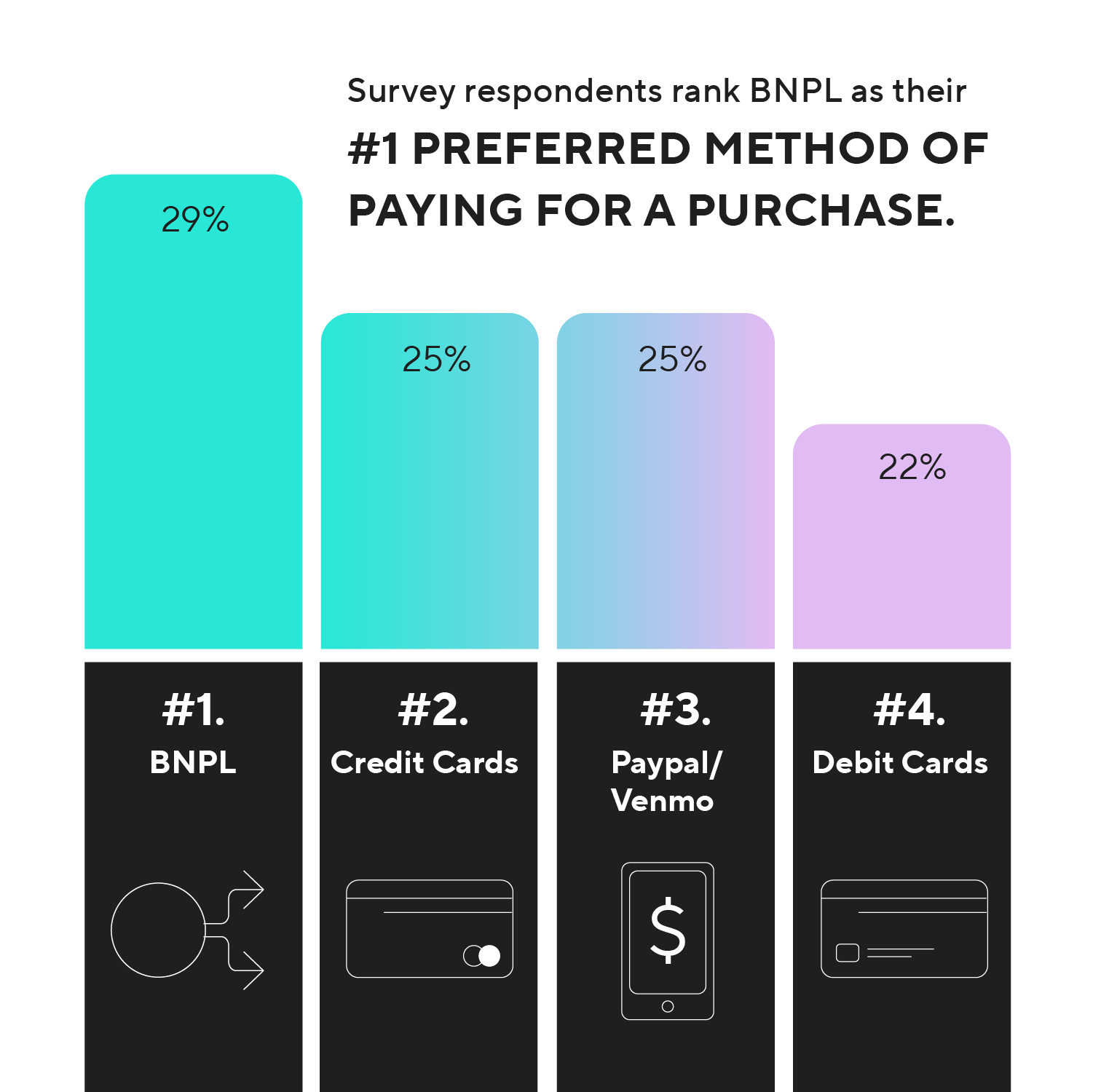

However, Amount’s study reveals that BNPL will likely have great staying power. In fact, BNPL usage is growing exponentially, more than doubling in 2021. Our survey respondents rank BNPL as their #1 preferred method of paying for a purchase, beating out credit cards, debit cards, PayPal and Venmo. It is also a preferred form of payment among affluent households, with 87% of households with over $100,000 in annual income claiming interest in BNPL.

In short, the high growth and public demand for BNPL suggest it will be a long-lasting payment option for consumers worldwide.

2. BNPL users have poor credit histories.

Since it is relatively new and used broadly by younger consumers, BNPL has to contend with a perception that it is somehow less legitimate than other forms of payment. This perception leads to another persistent myth — that BNPL users have poor credit histories.

Contrary to the myth, Amount’s study found that BNPL users tend to have strong credit histories. In reality, seven in 10 BNPL users have a credit rating of excellent or good. Moreover, BNPL users possess many other markers of consumers with solid credit. Specifically, two-thirds of BNPL users have a college degree or more, nearly 60% are homeowners and three-quarters are the financial decision-makers for their households.

3. BNPL is mostly used for small-ticket items.

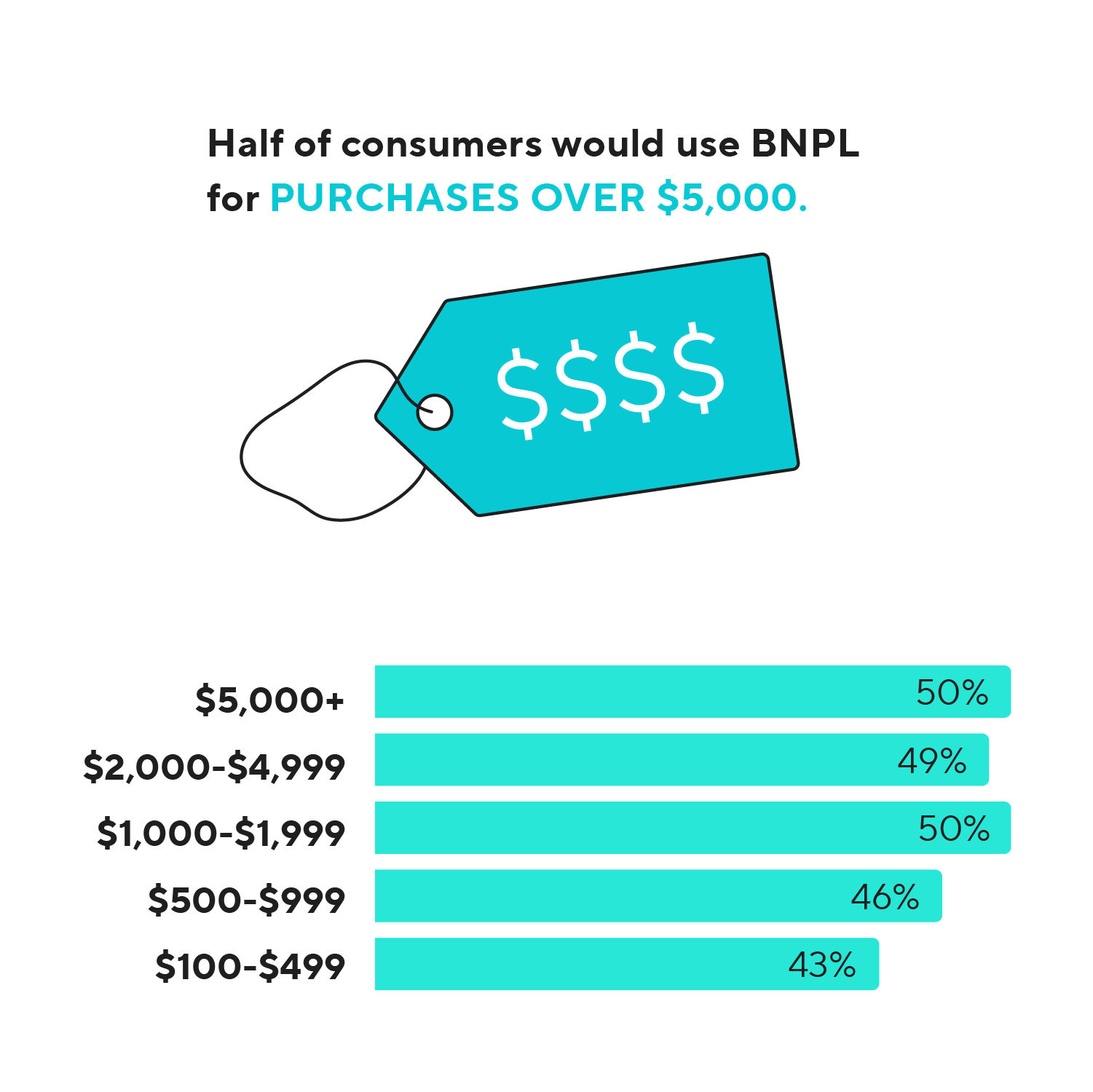

Yet another misperception is that BNPL is a form of payment mainly reserved for small-ticket items. But the fact is that BNPL is very popular for larger purchases, since half of all customers would use BNPL for purchases of over $5,000. The average largest purchase size for consumers ages 35 to 44 is $1,352. And 55% of customers said using BNPL encourages them to spend more money on purchases. Looking at these statistics, the “small-ticket only” reputation of BNPL appears to be far off base.

4. Banks can’t compete with BNPL providers.

The ultimate BNPL myth for banks is that they simply cannot compete with non-bank financial technology providers of this payment option. After all, the thinking goes, BNPL originated with these providers ─ wouldn’t they be the best at delivering this service?

But Amount’s research shows that banks actually have significant competitive advantages in the BNPL space. The majority of consumers would prefer a bank-backed BNPL offering over an offering from a non-bank or fintech company. And three-quarters of survey respondents would be likely to use a BNPL offering from their preferred bank.

Why?

The top reason consumers so clearly prefer bank-backed BNPL offerings, as cited by 58% of respondents, was trust in their bank. Banks can take advantage of this inherent trust and attract and retain customers with better pricing and credit offerings than fintechs. Plus, rising calls for increased regulation of BNPL providers pose less a threat to banks, which by nature, are well-versed in regulatory scrutiny and compliance.

The myths surrounding BNPL are so far off the mark, they border on fantasy. Contrary to the myths, BNPL appears to be a long-lasting solution for consumers with solid credit. Most importantly for banks, they have built-in advantages with BNPL offerings. Now may be the time for banks to realize the potential of the BNPL space for their long-term success.

To learn more about the big-picture value of BNPL and the opportunities it offers for the banking sector, read "Buy Now, Pay Later: Today's Greatest Customer Acquisition Opportunity for Banks"

Download Report

Download Report