Every upside has its downside — a truism valid in the financial world, where profit margins go hand-in-hand with concerns of fraud and regulatory overreach. Though digital expansion is proving wildly successful, it introduces a diverse set of security and administrative issues. The task of balancing risk and reward, always prominent in the financial world, has reached peak pertinence.

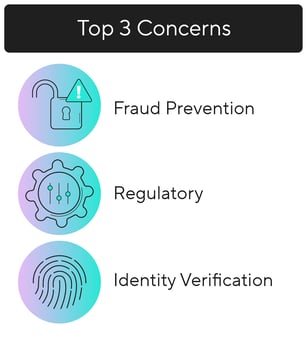

When conducting research for our report Getting Ahead of the Digital Banking Curve, developed in partnership with LendIt, we asked hundreds of banks, fintechs and financial institutions what risks are most concerning, internally, when developing new digital products or services. Responses suggest that Fraud Prevention, Regulatory, and Identity Verification concerns overwhelmingly impact digital product launch or expansion.

Over 32% of leaders ranked Fraud Prevention as their number one concern — and over 50% ranked it in the top two. Further, more than 60% of respondents ranked Regulatory in their top three — with 23% ranking it number one. Nearly 56% of institutions ranked Identity Verification (including KYC or KYB) in their top three.

Fewer than expected ranked Market Maturity near the top, suggesting that banks now view digital product expansion as essential — but harbor concern.

For some, risk-management worries waylay digital financial product launches. Given recent platform solutions advancement, however, partnerships may actually enhance compliance capabilities.

For banks with retail and commercial product ambitions, banking-as-a-service providers offer complete compliance and identity management solutions that both satisfy KYC/AML regulations and automate identity and risk decisioning via API connection. Interviewees reminded us that these can deploy in a matter of weeks, versus months or years for legacy tools in the past.

Perspectives on digital product go-to-market worries.

We relayed respondent concerns to industry experts and asked for perspectives on how to respond and/or navigate each. Here are a few important takeaways:

|

Reduce fraud risks by focusing on who you're building for.

One investor and digital payments expert suggested "hyper-selection" — or segmenting user populations to initially avoid prospects you perceive as riskiest. "Start with the top 1% of your customer base to extend a new product to. Apply learnings, then expand to the next 5%," he shares. Address remaining risks (e.g. — multiple technology integrations and onboarding issues) with the many robust KYC or identity verification solutions available. |

|

Apply what you do know.

An executive from one national bank encouraged legacy banks and FIs to apply existing institutional knowledge and lean on internal resources — but not to expect to figure it all out before executing. "We have an activity alert team, a fraud team, and credit risk teams. Although they use legacy tools, they had an idea of what to look out for with BNPL — including how to evaluate fintech platform tools and apply some fraud monitoring guidelines." |

|

Make learning low-stakes.

One bank executive who launched BNPL referenced a plan "to do a million dollars, then turn it off." He notes how total fraud risk was in the "low five-figures" and the low-stakes environment let the team learn and re-deploy to a wider customer base. |

|

|

Stay in your lane (e.g. — pursue partnership).

Often, attempts to over-architect fraud reduction creates poor user experiences and adds reputational risk. According to one banking leader, this is particularly common with "internal solution builds." Focus on what you're good at and find a like-minded partner who specializes in customer-facing experiences with legacy FIs, the leader suggests. |

|

Prioritize "battle-tested".

Given the outsized role new products introduction plays in determining whether partnership makes sense, partners must prove their story of accelerating digital transformation. Look for brands with a track record of success: Everyone talks about secure, seamless, or agile, but can they point to examples in the market. |

|

Manage your messaging.

FIs must prioritize open dialogue with regulators. According to one product leads, "If you can prove repeatable processes for identifying and solving concerns, regulators appreciate that." The key, according to another digital banking head, is "showing regulators that you just don't see a big post of gold and are chasing it with blinders on." Banks often have strong track records of compliance performance, and processes for steps like affordability checks. They should not reinvent these, nor ignore them — but apply what they know alongside partners to satisfy concerns from entities like the Consumer Financial Protection Bureau. |

Importantly, while risk management concerns were pronounced among surveyed banks and FIs, they aren't deal-breakers. According to interviewees, enterprise bank-grade infrastructure, and compliance, data privacy, and verification orchestration are now table stakes for top solution providers.

"We'd never learn if we didn't launch." - Marc Butterfield, SVP of Innovation & Disruption, First National Bank of Omaha

Further, many partner platforms were purpose-built for financial digital channel use. So although regulation may soon alter BNPL and other digital product landscapes, worry-free compliance and consumer-first experiences remain in reach.