Exchanging cash at checkout quickly became taboo as the global pandemic we’re still navigating forever changed how people interact. In the blink of an eye, contactless payments went from a “nice to have” to a “need to have.”

With this shift in consumer demand, one form of contactless payment in particular, virtual cards, surged in popularity. While virtual cards aren’t a new concept, the use cases for them have continued to grow as consumers, financial institutions (FIs) and businesses show an increasing interest in the digital option, especially with Buy Now Pay Later (BNPL) payments. To understand why this use case has become so popular, it’s worth taking a step back to look at why consumers, FIs and businesses are interested in the digital option.

What are virtual cards?

As the name implies, the key feature of virtual cards is the fact that they’re entirely digital, not physical. These virtual payment options can range from debit and credit cards to gift cards and one-time cards that are used to make a single purchase at a specific merchant.

People can apply for a virtual card online on an electronic device, like a smartphone or laptop. After the applicant has filled out the required information and submitted the application, the user is informed that the card is ready to use. Sometimes, but not always, the consumer will be able to add their new virtual card to a digital wallet (i.e., Apple Wallet, Google Pay). If the card cannot be stored, the user may be able to copy the card information to their device via “Copy” and “Paste” functionality.

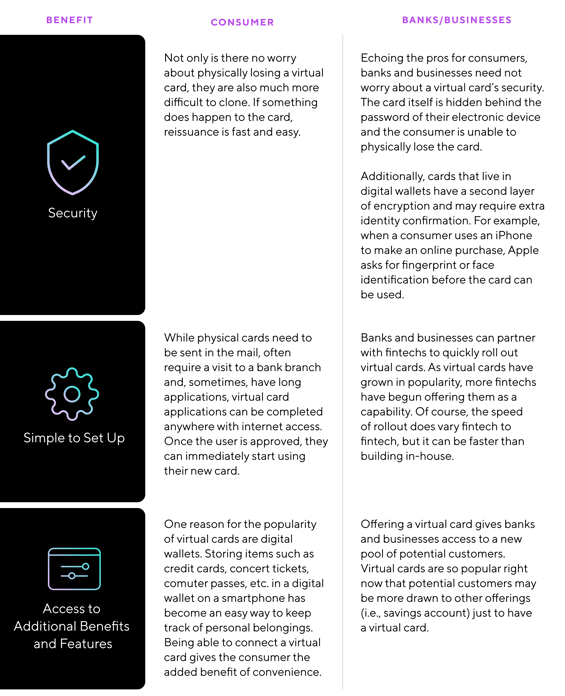

What are the benefits of virtual cards?

BNPL and Virtual Cards

We’ve seen a rise in BNPL providers including virtual cards in their offerings, which typically work similar to credit cards. Some offer a one-time card, allowing consumers to make one purchase. Whatever is spent on the card is then either split into four repayments or put on an interest-bearing installment loan in which the user will make monthly payments.

Other BNPL providers offer cards that work as a middle man, giving people the ability to split purchases into installment loans that are connected to a consumer’s outside funding source, such as a credit card or debit card. The virtual card is not tied to a specific merchant and can be used anywhere online or in-store that accepts contactless payments. This use case is interesting in that the virtual card cannot be used on its own like a debit or credit card -- it must be connected to an outside funding source.

BNPL providers have seen great success with these two use cases. The consumer does not need to do any heavy-lifting to access BNPL, and the virtual card gives people the flexibility to shop virtually anywhere and activate BNPL on their chosen purchases.

While many banks offer virtual cards, they often lack BNPL functionality. This is where partnering with a fintech comes into play. A strategic partnership with a fintech that gives banks the ability to offer customers virtual cards with BNPL will not only help banks keep up-to-speed with the fintechs, it will help drive stickiness with existing customers, increase customer lifetime value and even attract new customers seeking this functionality from a trusted bank.

While the events of the past two years have certainly created a space for virtual cards to thrive, especially in BNPL, the use cases will likely expand into other financial verticals in the years ahead. Between their ease of use and added security, they give banks yet another way to create a truly differentiated and valuable offering that enhances customer experiences.

Learn how Amount's virtual card capabilities are helping banks compete with BNPL fintechs.

Watch Video

Watch Video