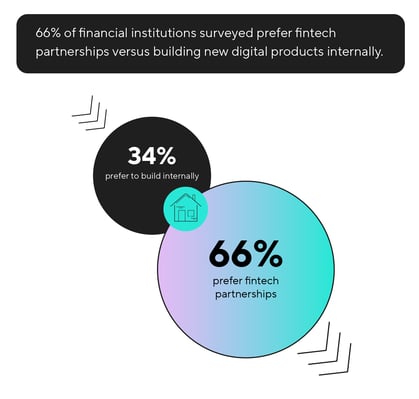

According to financial institutions we surveyed in partnership with Lendit for our bank study Getting Ahead of the Digital Banking Curve, 67% prefer fintech partnerships versus building new digital products internally. Although leaders overwhelmingly favored this approach, a meaningful amount (33%) favor in-house development.

Over 13% of respondents also describe Working with Vendors as a top risk surrounding digital products, Chris Dervan, SVP Consumer Lending Products at Fifth Third Bank, cautions against this mindset: "Play to your strengths," he notes. "Banks have great balance sheets and customer relationships. Allow partners to help you deliver great digital experiences."

Most partnership concerns are unfounded - and readily navigable.

Interestingly, multiple respondents who prefer in-house development actually cited "IT capacity" and "IT development bandwidth" as prohibitive to product launch.

Another oft-cited partnership concern is wasted investment in previous process and infrastructure. However, fintech product market advances mean that enterprise-ready solutions that integrate into a bank's existing infrastructure exist. For example, banks may have a preferred decision engine or risk model that they want to build around, not scrap. Fintech partners can fill these gaps, without requiring wholesale overhaul. Of course, this assumes these preferred internal functions generate value above-and-beyond partnership investment.

Engaging partners activates new products and services faster - an important differentiator given fluctuating consumer brand preferences. To stay relevant, banks must prioritize finding technology that improves flexibility, agility and speed to market. Further, most banks allocate technology spend toward keep-the-lights-on initiatives - rarely do they have the bandwidth or capability to build and launch new digital products.

Engaging partners activates new products and services faster - an important differentiator given fluctuating consumer brand preferences. To stay relevant, banks must prioritize finding technology that improves flexibility, agility and speed to market. Further, most banks allocate technology spend toward keep-the-lights-on initiatives - rarely do they have the bandwidth or capability to build and launch new digital products.

In some cases, banks and FIs should recalibrate their views of partnership as an all-or-nothing proposition. "The path forward is not binary; owning everything internally or having a fintech replace your enterprise," reminds Dervan. He suggests banks wade into partnership for functions stuck in a previous era: "Traditional fraud-fighting tools like identity verification, transaction monitoring and outlier detection are often blunt instruments - fintech partner expertise improves these."

Expertise by association.

Multiple respondents who are not launching digital installment credit products blamed a need for "more due diligence", "lack of expertise", and want for "more cautious planning." Although preparation is prudent, industry experts noted how the right fintech partner likely solves pressing issues.

"A great partner helps you vet and challenge ideas. They readily tell you about mistakes they've made, what they've learned from regulators or credit bureaus, and what is commercially essential for deployment," guides Dervan.

That said, not every partner is similarly beneficial.

.jpg?width=2121&name=iStock-1328677027%20(1).jpg)

"Play to your strengths. Banks have great balance sheets and customer relationships. Allow partners to help you deliver great digital experiences."

- Chris Dervan, SVP Consumer Lending Products at Fifth Third Bank

Kapil Mokhat, Managing Director at WestCap, advises banks to first assess their internal strengths and weaknesses and then map gaps against partner capabilities. "Take an honest assessment of what you can solve and where you need help. Then find partners who best serve where you're weak."

No interviewee mentioned a magic formula for finding the right partner. However, Mokhat summarized expert sentiment: "Make sure partner leadership shares the same customer obsession, knows your industry, and build products that can grow with you."

"The worst thing is deploying a beautiful, expensive solution that doesn't work for where your customers want to go next."

Where in-house development and ownership (might) make sense.

Christopher Smalley, Managing Director, Head of Digital Banking at Customers Bank, urges banks and FIs to first explore partnerships, however, he notes examples where in-house efforts may be worthwhile.

"In rare instances, you may have the internal horsepower and uniquely skilled staff - especially for specialty back-end products or services." According to Smalley, one overlooked benefit of building in-house efforts is the opportunity to "commercialize something best-in-class later on." He concedes that working in-house often requires more stakeholder buy-in and leads to "long product ramp times."

To learn more about how financial institutions are embracing digital innovation, read our full report "Getting Ahead of the Digital Banking Curve."

Download Report

Download Report