U.S. retail e-commerce sales are predicted to grow to nearly $ 1 trillion by 2023 as consumers shift their purchasing habits online.

With these shifting habits, consumers have steadily gained more payment alternatives that allow them to purchase goods and services without actually having that money in their possession. With these emerging choices available, merchants have become increasingly competitive by actually offering those payment options directly to consumers.

Perhaps the most popular option today is buy now, pay later.

What is buy now, pay later?

Buy now, pay later, or BNPL, is a pretty straightforward concept: customers opting to use this popular point-of-sale financing option can purchase something online or in-store and instead of paying full price up front, they’re able to pay later.

It’s easy to imagine how appealing this is to customers. Having the ability to finance purchases, in many cases with a period of no interest and no fees. What’s the catch?

There isn’t one. For consumers, anyway.

Begging the question: how does BNPL actually work? And what does it mean for your business?

How does BNPL work?

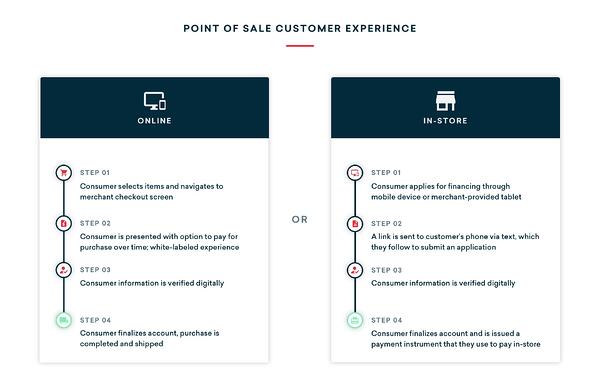

The process of using point-of-sale financing looks a little something like this:

The customer selects an item(s) for purchase and prepares to check out. At the point of sale they’re then presented with available payment options (we’ll discuss more about these options below). They proceed by selecting the plan that is right for them. Next, they’re verified digitally through a credit risk assessment. And finally, pending credit approval, they complete their purchase—all within a matter of minutes.

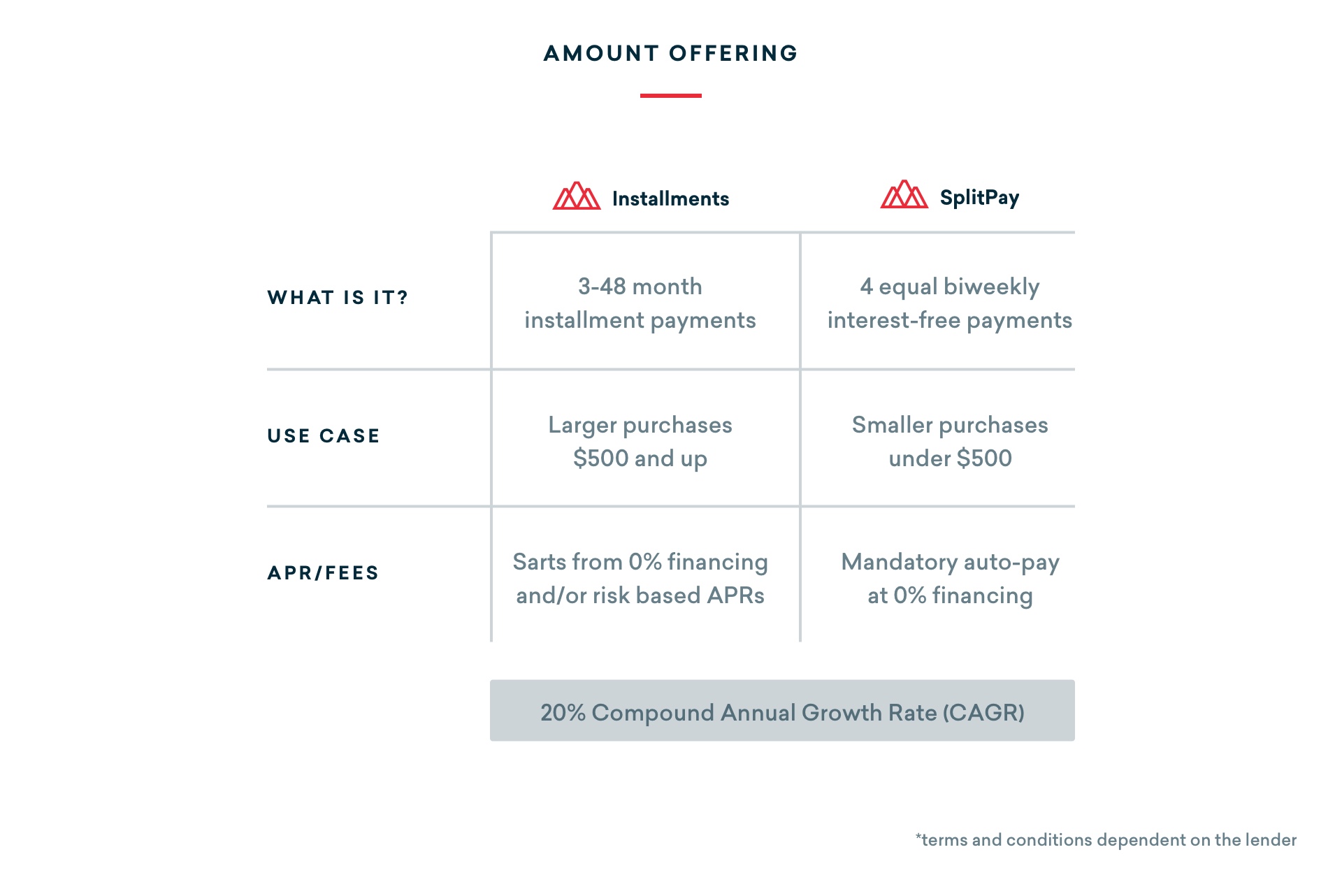

When it comes to specific financing options for consumers, there are a couple of options presented to them to finalize the purchase. While payment options and terms vary depending on the financing provider, two common payment options are split payments and installment loans.

Split payments

Split pay is a payment method that gives customers the flexibility to split their purchase into equal, interest and fee-free payments over the course of several installments.

Generally used for smaller ticket items that are less than $500, these series of payments are made with mandatory debit, credit or ACH auto-pay at 0% financing. Consumers choosing split pay are typically responsible for 2 to 6 payments within 60 days of the original purchase, with specific terms determined by the lender.

Installment loans

An installment loan is a type of loan where a consumer borrows a specific amount of money all at once. They repay the loan over a fixed number of installment payments.

Typically used for larger ticket items of $500 and up, customers opting for the installment lending option are able to finance their e-commerce or brick and mortar purchase generally for up to 48 months with 0% financing and/or risk-based APRs, as determined by the lender.

Benefits of offering buy now, pay later

Leading merchants offering point-of-sale financing to customers can:

Experience higher conversions and lower cart abandonment

Offering flexible financing on purchases can significantly influence the way that consumers make decisions. According to a recent emerging payments report by Deutsche Bank, 46% of customers who made a purchase using BNPL responded that their business would have been lost with no BNPL solution, while 41% said they would have delayed their purchase. Offering point-of-sale financing can significantly increase conversion rates. In fact, according to that same study, merchants could benefit from as much as ~20-30% higher average ticket sizes and a ~30% increase in conversions.

Increase sales and funnel growth

Not offering financing can limit your ability to grow your customer base. By providing flexible payment options for potential customers, you have an opportunity to expand your customer profile into new markets by competing with merchants who are already providing financing opportunities. Reaching these markets will allow you to increase both immediate sales and funnel growth.

Improve customer experience

Consumers want ease. With point-of-sale financing at checkout, customers can select a flexible payment plan that works for them, complete credit risk assessments, and finalize their purchase all in a matter of minutes. Presenting your customers with affordable payment options means less time spent debating the purchase—if you can offer something that makes that decision and process easier, you have successfully created a frictionless customer experience.

Boost customer loyalty and retention

Offering flexible payment options is not only crucial to building a customer base, but it’s also important when it comes to actually retaining it. If you can present appealing financing plans and a seamless customer experience for your customers for one product or solution, chances of those customers being loyal and returning for repeat business are high.

Compete with online and in-store retailers

Buy now, pay later is on the rise and here to stay. This trending financing option gives consumers the opportunity to finance purchases in smaller amounts over time with more confidence in their ability to pay it off without the additional interest of using a credit card. Because of this, demand is high (to no surprise).

For the time being, it’s possible to compete with these merchants providing financing to their customers, but it could become near-impossible as buy now, pay later continues to become popular among younger generations. So the quicker your business is equipped to keep up with this trend, the more likely you are to stay in competition with your peers who are offering financing. And for the retailers who aren’t adopting buy now, pay later, you’ve got a one up on these competitors.

Is buy now, pay later financing right for your business?

Now that we’ve covered the benefits of offering financing to your customers, it’s important to consider a few things before adopting a BNPL solution for your business:

Pricing of your products

When determining if BNPL is right for you, consider your product prices. Some financing providers have a price minimum for financing and will only offer payment options for higher priced goods or big-ticket items. If your core product offering is fairly expensive, bringing in a BNPL solution can help break down payments making your products more affordable for your customers.

Costs to consumers and merchants

Similar to credit card issuers, BNPL financing providers earn money by charging fees to both merchants and customers. Most point-of-sale financing providers don’t charge explicit interest and penalties, such as late fees, to customers, but depending on the provider, some may charge an interest fee or flat fee for late payments. However, BNPL financiers tend to be more transparent with fees, rates, and payment schedules typically displayed clearly. For merchants, accepting buy now, pay later is very similar to accepting credit card payments—merchants pay a fee(s) to complete a sale.

With buy now, pay later continuing to grow as an online payment preference, it’s crucial that merchants consider if and what point-of-sale financing solution is best for their business in order to be successful in the long run.

To learn more about BNPL and how to determine the right fit for your organization, read out blog "Buy Now, Pay Later Partnerships Models: Which is Right for your Financial Institution?"

Read Article

Read Article